is an inheritance taxable in michigan

Also inheritances arent taxable at the federal level but some states levy inheritance taxes. If you rent your home your credit depends on how much rent you pay the allowance for your filing category and the millage rate on the rented property.

Is There An Inheritance Tax In Michigan Axis Estate Planning

IRS Publication 525 has a more expansive list.

. Fortunately the IRS has a procedure to help. Income Tax Range. Inherited property is considered separate property in Michigan.

The millage rate is the non-homestead millage rate levied by your city or. IA ST 4512. The inheritance tax rate varies depending on the relationship of the inheritor to the decedent.

This tax affects the recipients of any inheritance who must pay a portion of the value of the property they receive in taxes. When does an executor have to pay beneficiaries. In the 2015 Summer Budget a new main residence transferable allowance was announced which.

If your third-round stimulus payment is lost stolen or destroyed you can ask the IRS to perform a payment trace to see if your check was cashed or. You never imagined youd find yourself in the middle of a. Taxable value of your homestead contact your local treasurer.

Gifts of cash and all payments made on your behalf must be included in total household resources. If you havent already set up your payment information or if you wish to make this contribution from a different bank account. The day you exchanged vows with your spouse you were ecstatic.

How long does probate take if there is a will. Wages salaries tips sick strike or Sub pay attach copies of all W-2s _____ All interest and dividend income including nontaxable. Special financial concerns for retirees include whether Social Security benefits are taxable at the state level property taxes and how retirement account and pension withdrawals are taxed.

It can take anywhere from six to eight months after filing an estate tax return before receiving any. There are seven states with no income tax. Legacies in wills and probate explained.

How long after probate is granted does it take to receive inheritance. 2 on taxable income from 4800 to 9499 for taxpayers with net income less than 23600 075 on first 4799 of taxable income for taxpayers with net income from. Remember to keep this copy with your tax recordsdocumentation for the appropriate year.

Alaska Florida Nevada South Dakota Texas Washington and Wyoming. A closing letter must be received from the state taxing authority as well if state estate taxes are also due. Do I need probate if I have power of attorney.

Another way to protect an inheritance is to have a spouse sign a post. Pennsylvania retirees who are planning their estate should be aware of the states inheritance tax. This replaced Indianas prior law enacted in 2012 which phased out Indianas inheritance tax over nine years beginning in 2013 and ending on December 31 2021 and increased the inheritance tax exemption amounts retroactive to January 1 2012.

Include both taxable and nontaxable income. To make an electronic funds transfer from a checking or savings account to your 529 plan follow these instructions. However an inheritance can become marital property if it is commingled or placed in a couples joint account.

The tax is 45 for. New Hampshire and Tennessee impose income taxes only on dividends and. The best way to avoid this is to place all inherited assets into a separate account and document all actions accordingly.

It takes longer to probate an estate that owes estate taxes because a taxable estate cant be closed until a closing letter is received from the Internal Revenue Service. When there is no Will who is the personal representative. The taxes are calculated based on the taxable estate value and estate and inheritance taxes must be paid before the assets are distributed to.

A E-file your Michigan Homestead Property Tax Credit Claim for Veterans and Blind People. What Happens if a Beneficiary Cant Be Found. In the tax year 202122 the inheritance tax nil-rate band also known as the inheritance tax threshold for individuals is 325000.

Pick-up tax is tied to federal state death tax credit. You had dreams of a bright future filled with financial security a dream home travel and maybe even a few kids. Have you received a tax return bonus inheritance or other lump sum you wish to put towards saving for college.

This nil-rate IHT band is transferable to a spouse or civil partner on death resulting in a total nil-rate band of 650000 for couples.

Twelve States And Washington D C Impose Estate Taxes And Six States Impose Inheritance Taxes Maryland Is The Onl Inheritance Tax Estate Tax Nightlife Travel

Michigan Inheritance Tax Estate Tax Guide Rochester Law Center

Is Your Inheritance Considered Taxable Income H R Block

How Will Buying A Flat For My Son Affect Inheritance Tax And My Other Children Inews In 2021 Inheritance Tax Inheritance Sons

Twelve States And Washington D C Impose Estate Taxes And Six States Impose Inheritance Taxes Maryland Is The Onl Inheritance Tax Estate Tax Nightlife Travel

Michigan Inheritance Tax Estate Tax Guide Rochester Law Center

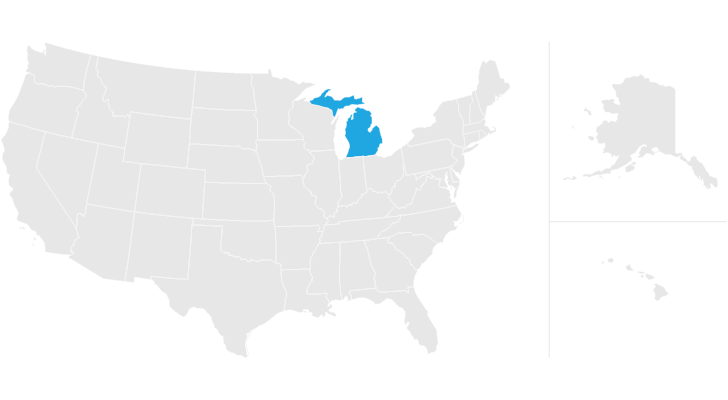

States With No Estate Tax Or Inheritance Tax Plan Where You Die

Michigan Estate Tax Everything You Need To Know Smartasset

Estate Tax And Inheritance Tax Considerations In Michigan Estate Planning